The Best Guide To Spotminders

Table of ContentsSpotminders for DummiesExamine This Report about SpotmindersThe Basic Principles Of Spotminders Some Ideas on Spotminders You Should KnowThe smart Trick of Spotminders That Nobody is DiscussingSpotminders for Beginners

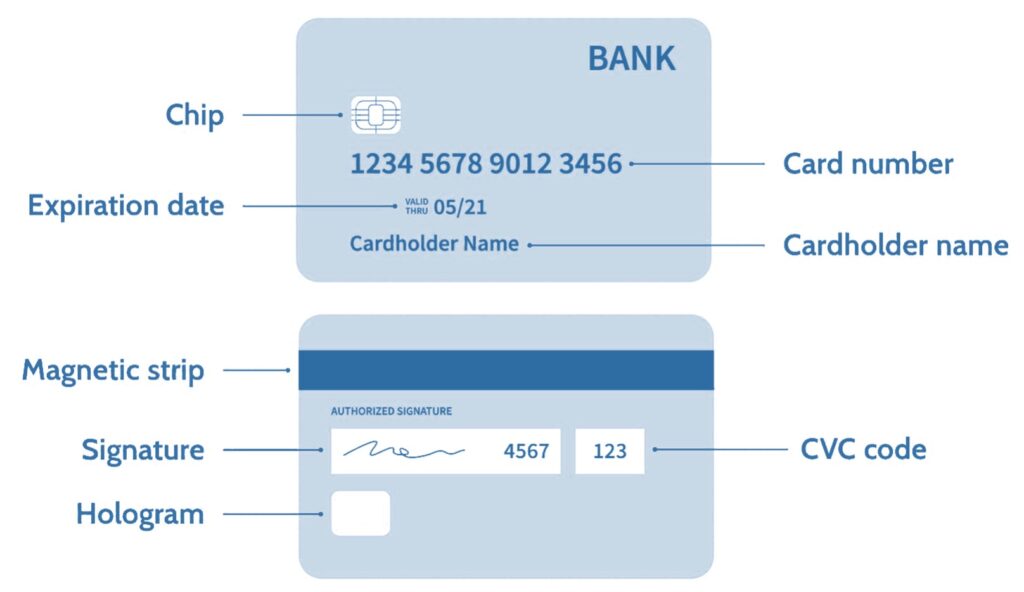

Date card was initial opened up Credit line you were approved for. This elements heavily right into Credit queries remain on your credit scores report for two years. This affects your credit rating, and company cards are not included The length of time you have actually had the credit rating card for and aspects into your credit report's calculation The annual fee associated with the credit history card.

Really feel cost-free to change Uses formulas to computer how numerous days are left for you to strike your minimum spendUses the bonus offer and amount of time columnsB When you obtained your bonus offer. There is conditional format right here that will certainly turn the cell environment-friendly when you input a date. Whether the card fees costs when making international deals.

It's essential to track canceled cards. Not just will this be a great scale for my credit score, but many credit report card incentives reset after.

Getting The Spotminders To Work

Chase is without a doubt one of the most stringiest with their 5/24 regulation however AMEX, Citi, Funding One, all have their own set of regulations too (car tracker) (https://sp8tmndrscrd.carrd.co/). I have actually produced a box on the "Present Stock" tab that tracks one of the most usual and concrete rules when it pertains to churning. These are all made with formulas and conditional formatting

Are you tired of missing out on out on possible financial savings and bank card promotions? If so, this CardPointers testimonial is for you. If you want to, this app is a game-changer! Prior to I found, I frequently rushed to pick the right bank card at checkout. Throughout the years as the number of cards in my purse grew, I had a hard time with keeping an eye on all my offers.

The 20-Second Trick For Spotminders

At some point, I wisened up and began taking down which cards to use for everyday purchases like dining, grocery stores, and paying details bills - https://www.4shared.com/u/AU9guPd-/timdavidson94104.html. My system had not been ideal, but it was better than absolutely nothing. CardPointers came along and changed how I handled my credit rating cards on the go, offering a much-needed remedy to my dilemma.

Which card should I utilize for this purchase? Am I missing out on unused rewards or credit ratings? Which credit history card is really offering me the most effective return? This app addresses all of that in secs. This click now blog post includes associate links. I might receive a little commission when you use my web link to purchase.

It helps in picking the right charge card at checkout and tracks offers and benefits. rechargeable tracking card. Just recently featured as Apple's App of the Day (May 2025), CardPointers helps me address the crucial inquiry: Available on Android and iOS (iPad and Apple Watch) devices, along with Chrome and Safari internet browser expansions, it can be accessed any place you are

What Does Spotminders Mean?

In the ever-changing globe of points and miles supplies become out-of-date quickly. As well as, sourcing every one of this details is taxing. CardPointers maintains us arranged with details about all our bank card and helps us promptly determine which cards to use for every single acquisition. Since the application updates instantly we can with confidence make one of the most informed decisions whenever.

With the we can earn 5x points per $1 for approximately $1,500 in Q4. Of that, we have $1,000 delegated spend. Simply in instance you neglected card benefits, look for any card information. With these beneficial insights within your reaches, take advantage of potential financial savings and incentives. CardPointers' user-friendly user interface, in addition to faster ways, custom-made views, and widgets, makes navigating the app easy.

The Greatest Guide To Spotminders

Neglecting a card could be an apparent blind area, so audit your in-app bank card portfolio twice a year and include your most recent cards as quickly as you've been accepted. This means, you're constantly approximately day. CardPointers costs $50 a year (Normal: $72) or $168 for life time access (Normal: $240).

CardPointers uses a cost-free variation and a paid version called CardPointers+. The free tier includes standard attributes, such as including credit score cards (limited to one of each type), checking out deals, and picking the best credit score cards based on details purchases.

Everything about Spotminders

Even this opt-out option is not available for customers to stop charge card business and providing banks from sharing this data with their financial affiliates and financial "joint marketers," a vaguely defined term that provides a giant technicality secretive securities. Nor do customers get the transparency they ought to regarding exactly how their details is being shared.

When the journalist Kashmir Hillside looked for out what was being done with her Amazon/Chase credit scores card data, both firms basically stonewalled her. The difficult variety of click-through agreements we're overloaded by online makes these notices simply part of a wave of small print and even much less purposeful. In 2002, residents in states around the country started to rebel against this policy by passing their very own, tougher "opt-in" financial personal privacy guidelines needing people's affirmative permission prior to their details could be shared.